Nine Lives Smarter FP&A

Excel shortcuts, templates & finance tool reviews — without the fluff

FP&A fundamentals, finance strategy, and surviving corporate chaos — one practical post at a time.

Quick Reads

Expand any topic to read the full post.

The FP&A Edge: Stay Ahead with AI-Driven Rolling Forecasts

The FP&A Edge: Stay Ahead with AI-Driven Rolling Forecasts

Annual budgets are slow. Markets are not.

By the time your 12-month budget is finalized, something in your business has already shifted — a sales dip, a supply chain delay, or a competitor’s surprise move. Rolling forecasts are how you avoid steering with last year’s map.

Instead of locking into a plan created months ago, a rolling forecast updates your financial outlook regularly — often monthly or quarterly — replacing the oldest period with a fresh one. That means your forecast window (e.g., 12 months ahead) is always up to date.

I recently put this into practice using AI tools. In minutes, I went from a raw dataset to:

📊 A dynamic rolling forecast

📈 A visual dashboard

The speed and accuracy were impressive — but more importantly, it removed the manual grind, freeing up time for analysis that wasn’t possible before.

Why it works:

🪄 Reduces surprises — decisions are made on current data, not outdated assumptions.

🔄 Increases agility — pivot budgets, headcount, or strategy before it’s too late.

💬 Drives better conversations — leadership sees the real trajectory, not stale numbers.

In FP&A, this agility is everything. It protects profitability, spots risks earlier, and gives you the confidence to make decisions that match where the business is headed — not where it used to be.

5 Corporate Budget Myths That Waste Your Time and Money

5 Corporate Budget Myths That Waste Your Time and Money

Annual budget season: the spreadsheets multiply, the coffee disappears, and somehow you’re still debating last year’s assumptions like they’re gospel truth.

The problem? A lot of corporate budgeting advice is based on myths that should have been retired with dial-up internet. Let’s bust a few:

“We finalize the budget once a year — that’s enough.”

Reality: Markets move faster than your locked spreadsheet. By month three, it’s already outdated.“Last year’s numbers are the best starting point.”

Reality: That’s like driving forward while staring in the rearview mirror.“Every expense must be justified from scratch.”

Reality: You’ll burn more analyst hours on penny debates than on spotting million-dollar risks.“More detail means more accuracy.”

Reality: At some point, you’re just rearranging deck chairs on the Titanic.“The budget is the plan.”

Reality: It’s just a snapshot — the real plan lives in your rolling forecast and actual results.

The takeaway: Stop defending outdated budgets. Spend your energy where it actually changes the outcome — adjusting, responding, and making decisions in real time.

Why Your Forecast Fails: 4 FP&A Mistakes Leaders Make

Why Your Forecast Fails: 4 FP&A Mistakes Leaders Make

In theory, a forecast should be your roadmap — helping you anticipate challenges, seize opportunities, and make confident decisions.

In reality, many leaders end up with forecasts that mislead more than they guide.

Here are four common reasons forecasts fail — and how to fix them:

1. Relying on Static, Annual Plans

An annual forecast that never gets updated is outdated the moment it’s finished.

Fix: Move to a rolling forecast model, updating key assumptions regularly to reflect market shifts, sales trends, and cost changes.

2. Ignoring Driver-Based Planning

If your forecast is just last year’s numbers with a percentage increase, you’re missing the story behind the numbers.

Fix: Identify and model the true drivers — volume, pricing, headcount, customer acquisition — so you can see why results are moving.

3. Overcomplicating the Model

Forecasts packed with hundreds of unused lines and overly complex formulas slow decision-making.

Fix: Keep it lean. Focus on the metrics that actually influence performance, and cut the noise.

4. Not Aligning Finance With Operations

If your operations team isn’t involved in building or reviewing the forecast, you’re working in a vacuum.

Fix: Collaborate with department leads to ensure the forecast reflects real-world constraints and opportunities.

Bottom line:

A good forecast isn’t about perfection — it’s about building a living, flexible plan that helps you react faster and with more confidence.

Cash Flow Mastery: How to Keep Business Running Smoothly

Cash Flow Mastery: How to Keep Business Running Smoothly

When it comes to running a business, cash flow isn’t just an accounting term — it’s your lifeline. You can have strong sales, loyal customers, and great products, but if money isn’t moving through your business in a healthy way, things can grind to a halt. Over the years, I’ve seen cash flow make or break companies — and the ones that thrive treat it as a daily habit, not a year-end panic.

1. Know Your Numbers Daily

It’s not enough to check your bank balance once in a while. Review your inflows and outflows regularly so you always know where you stand. A small surprise today can become a big crisis tomorrow if you’re not watching.

2. Forecast, Don’t Just Track

A cash flow forecast helps you predict slow months, plan for big expenses, and avoid scrambling for emergency funding. Even a simple rolling forecast can make the difference between confident growth and constant stress.

3. Speed Up the Money Coming In

Tighten your invoicing process, send reminders before payments are late, and consider incentives for early payments. The sooner money is in your account, the smoother everything runs.

4. Stretch Out the Money Going Out

Negotiate payment terms with vendors where possible. Spacing out large expenses or aligning them with your incoming revenue can reduce cash crunches.

5. Build a Safety Cushion

A cash reserve isn’t just for emergencies — it’s a signal to your team and stakeholders that you can weather the unexpected without losing momentum.

Why We Recommend QuickBooks for Small Business Owners

Why We Recommend QuickBooks for Small Business Owners

When you’re running a business, the last thing you want is to spend hours buried in spreadsheets and receipts. Over the years, I’ve tested different accounting tools, but QuickBooks consistently stands out — not because it’s flashy, but because it’s practical and built for how business owners actually work.

1. It Centralizes Everything

QuickBooks pulls together your income, expenses, and reports in one place. No more bouncing between different systems or trying to match up data manually.

2. Automates the Repetitive Stuff

From invoicing to bank reconciliation, QuickBooks handles the recurring admin work so you can focus on running your business.

3. Improves Cash Flow Visibility

Knowing exactly where your cash is at any given moment is huge. QuickBooks makes it easy to see incoming and outgoing money so you can make informed decisions before things get tight.

4. Makes Tax Season Less Painful

With expense tracking and receipt matching built in, you’ll spend less time scrambling for documents and more time getting on with your business.

Exclusive 30% Off Link

If you’ve been thinking about making the switch, QuickBooks is offering 30% off for 6 months.

15 Red Flags Every Business Owner Ignores (Until It's Too Late)

15 Red Flags Every Business Owner Ignores (Until It's Too Late)

I've seen it happen over and over again. A business owner thinks everything is fine — revenue is growing, customers are happy, the team is busy — and then suddenly, they're scrambling to make payroll or watching their best client walk away.

The warning signs were there all along. They just weren't looking at the right numbers. After working with dozens of small businesses and multi-location companies, I've identified the 15 most dangerous financial red flags that business owners consistently ignore. Some seem minor. Others feel "normal" because "that's just how business works." But each one can quietly drain your profits or put your entire operation at risk.

Here's what to watch for — and what to do about it.

Cash Flow Red Flags

1. You Don't Know Your Cash Runway

The Red Flag: You can't quickly tell me how many months of expenses your business can cover with current cash.

Why It Matters: Cash flow problems kill more businesses than lack of sales. I've worked with profitable companies that nearly folded because they couldn't bridge a 60-day gap between a big expense and customer payments.

What to Do: Calculate your monthly fixed expenses and divide by your current cash balance. If it's less than 3 months, you need a plan immediately.

2. Customers Take Forever to Pay

The Red Flag: Your Days Sales Outstanding (DSO) keeps creeping up, but you're not addressing it.

Why It Matters: One client's slow payment can create a domino effect. I've seen businesses with healthy margins struggle because 30-day payment terms turned into 60, then 90 days.

What to Do: Track DSO monthly. If it's over 45 days, implement stricter collection processes and consider requiring deposits for new work.

3. You're Always Surprised by Cash Needs

The Red Flag: Equipment breaks, taxes come due, or seasonal dips catch you off guard every time.

Why It Matters: Reactive cash management leads to expensive decisions — taking high-interest loans, missing vendor discounts, or turning down growth opportunities.

What to Do: Build a rolling 13-week cash flow forecast. Update it weekly. This simple habit has saved clients from countless financial crises.

4. Your Cash Conversion Cycle Is Getting Longer

The Red Flag: It's taking longer and longer to turn your work into actual cash in the bank.

Why It Matters: The longer money is tied up in your process, the more working capital you need to operate. This is especially dangerous for growing businesses.

What to Do: Map out exactly how long it takes from starting work to collecting payment. Look for bottlenecks you can eliminate.

Profitability Red Flags

5. Your Gross Margins Are Sliding

The Red Flag: Gross margin dropped from 40% to 35% over six months, but you haven't investigated why.

Why It Matters: Small margin erosions compound quickly. A 5% drop in gross margin can eliminate your entire profit if you're not careful.

What to Do: Track gross margin monthly by product/service line. When it drops, immediately dig into whether it's pricing, costs, or mix issues.

6. You Don't Know Your Break-Even Point

The Red Flag: You can't quickly tell me exactly how much revenue you need to cover all expenses.

Why It Matters: How can you make smart decisions about spending, hiring, or pricing without knowing your break-even? I've seen owners overspend during slow months because they didn't understand their true cost structure.

What to Do: Calculate your monthly fixed costs and variable cost percentage. Know exactly what revenue level keeps the lights on.

7. You're Not Tracking Customer Profitability

The Red Flag: You assume all customers are profitable because they pay their bills.

Why It Matters: The 80/20 rule applies to profits, not just revenue. Some customers might be costing you money while others fund the entire business.

What to Do: Calculate the true cost to serve each major customer, including all the "hidden" time and resources they consume.

8. Your Unit Economics Don't Make Sense

The Red Flag: You're spending more to acquire customers than they'll ever be worth to your business.

Why It Matters: This is like digging a hole with a bigger shovel. You can't scale unprofitable unit economics — you'll just lose money faster.

What to Do: Calculate Customer Lifetime Value (LTV) and Customer Acquisition Cost (CAC). Your LTV should be at least 3x your CAC.

Growth Red Flags

9. Revenue Growth Is Masking Declining Performance

The Red Flag: Revenue is up 20%, but profits are flat or declining.

Why It Matters: Growth without profitability improvement often means you're buying revenue with unsustainable practices. Eventually, this catches up with you.

What to Do: Track profit per customer and profit per employee alongside revenue growth. Make sure all metrics are moving in the right direction.

10. Customer Retention Is Quietly Falling

The Red Flag: You're so focused on new customer acquisition that you don't notice existing customers leaving.

Why It Matters: Acquiring new customers costs 5-25x more than retaining existing ones. A small drop in retention can devastate your economics.

What to Do: Calculate monthly churn rate and track it religiously. If retention drops below 90%, figure out why immediately.

11. You're Growing Without Understanding Market Position

The Red Flag: You're adding locations or services without knowing how you compare to competitors.

Why It Matters: Growth in a declining market or against stronger competitors can be a trap. You might be winning a losing game.

What to Do: Regularly benchmark your pricing, service levels, and market share against key competitors.

Risk Red Flags

12. One Customer Dominates Your Revenue

The Red Flag: Your biggest customer represents more than 20% of your revenue.

Why It Matters: Customer concentration risk can kill your business overnight. I've seen companies lose 40% of their revenue when one major client switched vendors.

What to Do: Actively diversify your customer base. If you have concentration risk, build relationships with potential replacement customers now.

13. Your Debt Levels Are Creeping Up

The Red Flag: Your debt-to-equity ratio keeps rising, but you're not monitoring it.

Why It Matters: High debt levels reduce your flexibility and increase your risk during downturns. Banks notice this too — making future financing harder to get.

What to Do: Track your debt-to-equity ratio monthly. If it's above 1.0, develop a plan to pay down debt or increase equity.

14. Seasonal Patterns Catch You Off Guard Every Year

The Red Flag: You know your business has seasonal fluctuations, but you don't plan for them.

Why It Matters: Predictable problems should never become crises. If you know January is slow every year, why are you surprised when cash gets tight?

What to Do: Map out your seasonal patterns over the last 3 years. Build seasonal assumptions into your cash flow forecasts and budgets.

Planning Red Flags

15. You're Flying Blind Without a Forecast

The Red Flag: You don't have a detailed financial forecast for the next 6 months, or it's so outdated it's worthless.

Why It Matters: Business without forecasting is like driving at night without headlights. You can't see problems coming until you're already in the ditch.

What to Do: Build a rolling 6-month forecast that you update monthly. Include revenue, expenses, cash flow, and key metrics.

The Bottom Line

Here's what I've learned after helping dozens of businesses get their finances under control: these red flags don't usually appear overnight. They develop slowly, quietly, while you're busy running your business.

The companies that thrive are the ones that catch these warning signs early and take action. The ones that struggle are the ones that ignore the signals until it's almost too late.

How Many Red Flags Are You Ignoring?

I've turned these 15 red flags into a simple checklist that you can use to assess your own business's financial health. It takes about 10 minutes to complete, and it'll show you exactly which areas need your attention first.

Don't wait until these red flags become full-blown crises. Your business deserves better than that — and so do you.

Want help addressing the red flags you've discovered? I work with multi-location and growing businesses to turn messy spreadsheets into clear dashboards, forecasts, and action plans — usually within 1-2 weeks. Let's discuss your specific situation in a free consultation.

Early Morning Productivity Edge With My AI Helpers

Early Morning Productivity Edge With My AI Helpers

Why 6 AM? There's something about the quiet hours before the world wakes up that makes complex analytical work flow better. No interruptions, fresh mental energy, and the satisfaction of accomplishing something meaningful before most people have their first cup of coffee.

Plus, there's a psychological advantage: when you start your day with a significant win, everything else feels more manageable.

The Bigger Picture: FP&A's AI-Enhanced Future

This experiment reinforced my belief that the future of FP&A is collaborative intelligence:

Humans provide business context and strategic thinking

AI provides speed, research capability, and framework structure

Together, we deliver better outcomes faster

We're not just making our jobs easier—we're making our insights more valuable by spending time on analysis rather than administrative work.

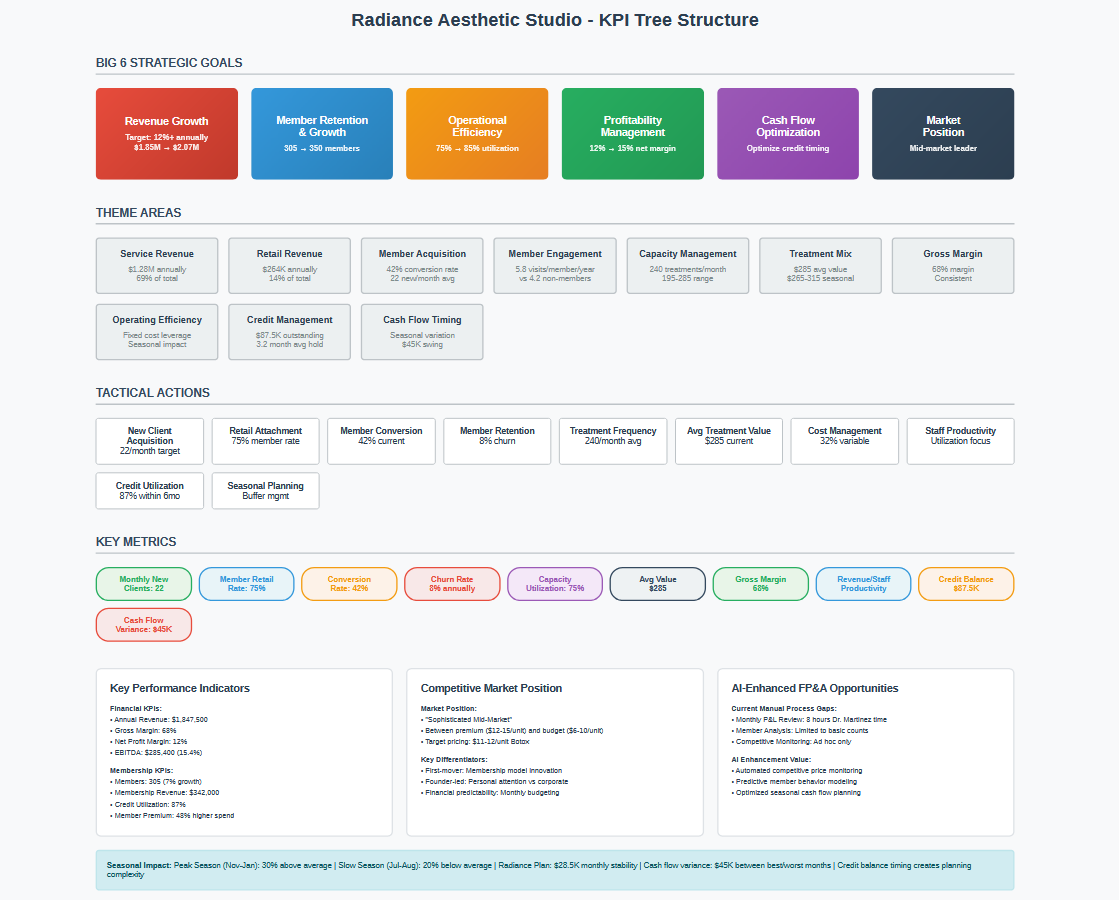

The tools are evolving rapidly, but the core principle remains: use AI to amplify your expertise, not replace your judgment. Here is the sneak peak at the next case study!

*Note: This is a mock client with data crafted with AI for demonstration purposes.

Ready to explore how AI can enhance your FP&A processes? Contact me to discuss your specific challenges and opportunities.

Med Spa Membership Programs: The Hidden Financial Risks

Med Spa Membership Programs: The Hidden Financial Risks

How popular prepaid membership models can create unexpected cash flow problems and margin erosion — and what to do about it.

Med spa membership programs have become the industry standard for building customer loyalty and creating predictable revenue streams. Walk into any modern med spa and you'll likely encounter some version of the same offer: monthly deposits with blanket discounts across all services.

On the surface, these programs seem like a win-win. Customers get discounted treatments, and operators get guaranteed monthly revenue with built-in loyalty. But a strategic financial analysis of typical membership structures reveals some concerning risks hiding beneath these popular programs.

The Analysis: Strategic Framework

I developed an analytical framework to examine typical membership structures common across the industry:

$100 monthly member deposits

20% blanket discounts on all services

25+ location franchise networks

Cross-location redemption privileges

This framework focused on three critical areas that require careful financial monitoring: prepaid liability management, service-line margin impact, and operational capacity reality.

What This Analytical Framework Examined:

Coverage Ratio Risk: Whether some locations might accumulate disproportionate prepaid obligations relative to their service delivery capacity, creating potential cash flow pressures.

Seasonal Liability Pattern: How holiday gift purchases and New Year resolution spending could create Q1 service delivery pressures when redemptions spike but new deposits decline.

Cash Flow Timing Mismatch: Whether redemption periods create revenue collection gaps where service delivery exceeds new cash coming in, particularly during post-holiday months.

Hidden Risk #1: Prepaid Liability Time Bombs

The Problem: Prepaid liability risk can vary dramatically across locations, creating cash flow landmines.

When members deposit $100 monthly but don't immediately use those credits, you're essentially borrowing money from your customers. This creates a liability on your balance sheet that must eventually be fulfilled through service delivery.

Key Risk Areas:

Coverage Ratio Disparities: Some locations might maintain healthy service coverage while others accumulate excessive obligations

Seasonal Liability Spikes: Holiday gift purchases could create significant Q1 service obligations

Cash Flow Reality Check: Post-holiday periods when service delivery exceeds new cash deposits

Strategic Controls:

Monitor coverage ratios monthly across all locations

Build seasonal cash reserves to handle Q1 redemption spikes

Consider deposit caps or redemption timelines to prevent excessive liability accumulation

Track location-level trends to identify problem areas before they become critical

Hidden Risk #2: Margin Erosion on High-Value Services

The Problem: Blanket discounts can push margins below sustainability thresholds on consumable-heavy treatments.

Not all med spa services have equal margin characteristics. A consultation has very different cost structures than injectable treatments or device-based services with expensive consumables.

Key Risk Areas This Framework Would Examine:

High-Consumable Margin Risk: Blanket discounts on treatments with expensive product costs could potentially push profitable services into negative territory.

Service Category Vulnerability: Different treatment types respond differently to uniform discount structures, with high-consumable services being particularly vulnerable.

Loyalty Program Paradox: The most engaged members using benefits frequently on premium treatments might represent the lowest-margin business.

Strategic Solutions:

Implement tiered discount structures based on service type and margin profiles

Exclude high-consumable treatments from blanket discounts or offer smaller reductions

Create member-only services with pricing that accounts for discount structures

Monitor service-line profitability monthly, not just overall location performance

Hidden Risk #3: The Capacity Utilization Illusion

The Problem: "Fully booked" schedules don't necessarily equal optimal revenue generation.

The assumption that full schedules equal maximized capacity may not account for revenue optimization opportunities.

Capacity Utilization Risks to Examine:

True Utilization Efficiency: Whether there's a gap between appointment volume and revenue-per-hour optimization. A location might be "booked solid" but not generating optimal revenue per scheduled hour.

Member Redemption Impact: How member redemption timing might affect capacity allocation and overall profitability. For example, whether high-value clients get crowded out by lower-margin member appointments during peak times.

Provider Productivity Variables: Whether the relationship between "fully booked" schedules and revenue generation varies by provider, time of day, or service type.

Optimization Strategies:

Track revenue per scheduled hour, not just appointment volume

Implement dynamic scheduling that prioritizes high-margin appointments during peak times

Analyze provider productivity individually to identify improvement opportunities

Consider member scheduling restrictions during peak demand periods

The Seasonal Cash Flow Challenge

Based on industry data showing December gift card spikes and January/February redemption patterns, seasonal cash planning appears critical for membership programs. Here's the potential cycle:

December: Members likely load up deposits for holiday gifts and New Year resolutions. Cash flow looks strong.

January/February: Members may redeem stored credits more aggressively. Operations deliver services but receive minimal new cash deposits.

March: Cash flow potentially normalizes, but working capital could be stressed for two months.

The Strategic Response: Build seasonal cash reserves during strong deposit months to handle redemption-heavy periods without compromising service quality or cash flow.

Strategic Approaches for Membership Programs

The goal isn't to eliminate membership programs — they provide genuine value for customer retention and revenue predictability. The goal would be to structure them intelligently so they enhance profitability rather than undermining it.

Recommended Financial Controls:

Pricing Guardrails: Not all services should carry the same discount structure

Seasonal Liability Planning: Build cash reserves for predictable redemption cycles

Capacity Optimization: Focus on revenue per hour, not just schedule density

Location-Level Monitoring: Track liability and utilization metrics across all locations

The Strategic Opportunity

These prepaid credit programs are spreading rapidly across wellness, fitness, and beauty industries. The operators who master the financial controls while maintaining the customer loyalty benefits could have a significant competitive advantage.

Bottom Line

This analysis suggests that strategic membership program design could help protect cash flow and margins while keeping the customer loyalty benefits that make these programs valuable.

The key would be treating membership programs as sophisticated financial instruments that require ongoing monitoring and optimization, not just customer retention tools.

Interested in discussing financial planning strategies for subscription-based business models? Nine Lives Strategy helps multi-location and growing businesses develop financial clarity through custom analysis, dashboards, and strategic frameworks.

Want to explore strategic financial planning approaches? Schedule a free 30-minute consultation to discuss analytical frameworks for your business.

About the Author

This strategic analysis was developed by Nine Lives Strategy, which helps multi-location and growing businesses get financial clarity through custom dashboards, rolling forecasts, and strategic KPI frameworks. Learn more at ninelivesstrategy.com.

The Small Business FP&A Reality Check: Why You Don't Need to Be a Fortune 500 Company to Get Your Finances Straight

The Small Business FP&A Reality Check: Why You Don't Need to Be a Fortune 500 Company to Get Your Finances Straight

Let's be honest. When you started your business, "Financial Planning & Analysis" probably wasn't on your list of things that excited you. You had a product to build, customers to serve, and a vision to chase. But somewhere along the way, the numbers started getting messy, and now you're drowning in spreadsheets that would make even Excel itself file for therapy.

Sound familiar? You're not alone.

The Big Firm Trap That's Stealing Your Sleep

Here's what happens to most small business owners: they Google "financial planning" once at 2 AM (we've all been there), and suddenly they're convinced they need enterprise-level FP&A solutions. The internet tells them they need complex financial models, quarterly board presentations, and a team of analysts with MBAs from schools they can't pronounce.

So they either:

Hire an expensive consultant who builds them a 47-tab monster that breaks every time they sneeze

Try to DIY it and end up with formulas that would confuse NASA

Give up entirely and just wing it (hello, stress-induced insomnia!)

What You Actually Need: The Nine Lives Approach

Here's the thing—your business doesn't need to look like Goldman Sachs to have solid financials. What you need is clarity, not complexity. You need answers, not academic exercises.

At Nine Lives Strategy, we've seen this movie too many times. Business owners torture themselves trying to build the "perfect" financial model when what they really need is simple:

Can I make payroll next month? Is this new location going to sink me? Should I hire that person or wait?

These aren't Fortune 500 problems. They're small business problems that need small business solutions.

The Big 6 vs. The Big Headache

Instead of tracking 47 different metrics (because someone on LinkedIn said you should), focus on your Big 6—the key drivers that actually move the needle in your business. Maybe it's customer acquisition cost and lifetime value. Maybe its inventory turns and gross margin. Maybe it's something completely unique to your industry.

The point is: your business has 5-6 metrics that, if you nail them, everything else falls into place. Find those. Track those. Ignore the rest.

Speed Matters (Because Your Business Won't Wait)

Traditional FP&A consulting moves at the speed of government bureaucracy. Six-month implementations, endless discovery phases, and models that are outdated before they're finished. Meanwhile, your business is making decisions daily that could make or break your year.

What if you could get clear financial insights in 1-2 weeks instead? What if you could actually sleep at night knowing where your business stands and where it's headed?

That's not wishful thinking. That's just smart FP&A designed for how small businesses actually operate.

The Real ROI of Financial Clarity

Good FP&A isn't about impressing anyone with fancy charts (though ours do look pretty good). It's about:

Confidence in your decisions: No more "gut feeling" pricing or hiring choices

Early warning systems: Spot problems before they become crises

Growth without panic: Scale knowing your numbers can handle it

Better sleep: Because uncertainty is exhausting

Why Our Approach Works

Small businesses need financial planning that's as scrappy and resourceful as they are. You need nine lives because Plan A rarely survives contact with reality. You need someone who gets that cash flow is more important than perfect GAAP compliance. You need FP&A with attitude.

The Bottom Line (Literally)

Your business deserves better than Excel nightmares and consultant bills that could fund a small country. You deserve financial clarity that actually helps you run your business better, delivered fast enough to matter, at a price that won't break your budget.

Because at the end of the day, good FP&A should give you one thing: peace of mind. Everything else is just fancy spreadsheet theater.

Ready to get your finances sorted without the big-firm price tag? Let's talk. Book a free 30-minute consultation and see how fast we can bring clarity to your numbers.

AI-Enhanced FP&A Solutions

Start with a free 30-minute consultation. From there, choose from our tiered FP&A packages - from one-time strategic foundation to ongoing AI-enhanced support with automated dashboards, competitive intelligence, and actionable insights built for your business needs.

Expert analysis enhanced by AI technology. Book your call now.

Never Miss an Insight

Strategic business analysis and financial frameworks straight to you

Get Your Free Small Business Financial Health Checklist

15 critical KPIs every business owner should track - find out which ones you're missing in just 10 minutes.